Table of Content

Tracking invoices is an essential aspect of business management that can significantly impact your business’s financial health and operational success.

This article comprises a guideline on practical tips, best practices, and ways to keep track of invoices to smoothen activities and not fall into these common pitfalls. Effective invoice management enhances cash flow, but it also promotes transparency and efficiency in the business.

Read on to learn more about the benefits of invoice tracking appropriately done and let yourself find some valuable tips for your invoicing process optimization.

What is Invoice Tracking?

Invoice tracking is an indispensable business routine that paves the way for smooth financial operations and healthy cash flow.

It is the procedure of keeping a systematic eye on all invoices from their creation to their eventual payment to bring about transparency and control over incoming and outgoing payments.

The Invoice Tracking Process

THE REST AFTER THIS AD

- Generating Invoices: The track of an invoice starts from the point of its creation. An invoice is prepared which holds all the information about the provided product or service along with the quantity, price, and payment terms.

- Sending Invoices: After being prepared, invoices need to be dispatched to customers or clients. It is sent through ordinary mail, e-mail, or invoicing software. This ensures that the invoices are dispatched on time, hence setting up a clear picture of when payment is expected.

- Recording Invoices: An invoice must be recorded accurately in an accounting system or financial software. This would involve tracking information presented on an invoice—amounts, due dates, and terms, if any, agreed to.

- Monitoring Payment Status: If there were one area of invoice tracking that is considered most important, it would be monitoring the status of each invoice. This includes knowing if invoices have been paid, partially paid, or not paid at all. This helps in establishing which ones are overdue and the company’s financial position at any one point in time.

- Following Up on Payments: When payments are late, good follow-up with clients is carried out to make it easier to get the payments. This can even involve writing letters or calling some clients. Good follow-up practice tends to reduce the average time of unpaid invoices —improving cash flow.

- Resolving Discrepancies: Sometimes, what was invoiced differs from what the client feels is payable. All these issues must get resolved in the shortest time. This may refer to setting the mistake, satisfying the client’s complaint, or negotiating with the client on new terms. The immediate resolution maintains the relationship of a business with its customers and also makes customers pay at the right time without delays.

- Updating Financial Records: With payments received and issues resolved, the financial records should be updated for an appropriate reflection of the business finances. This step shall ensure that the company’s financial statements are current and display an accurate and fair view of its health.

The invoices shall be tracked in two significant directions:

- Tracking Customer Invoices (Accounts Receivable): This is the tracking of invoices sent to the customers. Accounts receivable software will track invoice numbers, the number of days outstanding and send payment reminders to the customers so that they pay on time. Accurate customer invoice tracking would ensure that proper receivables are received on time and, consequently, the right effect on cash flow and financial stability.

- Tracking Supplier Invoices (Accounts Payable): Tracking invoices from suppliers to consistently pay for and at the right time. For instance, if there is a purchase order that has been created for new inventory, the accounts payable system can manage an incoming invoice from the supplier that was about the original purchase order; accurate and timely payment is provided by the same. Proper management of supplier invoices secures good relations with vendors and also ensures a smooth supply chain.

Invoice tracking is essential for any business, as it offers many advantages that contribute to being financially healthy and operationally effective.

Benefits of Tracking Invoices for your Business

Effective invoicing tracking has several advantages. Let us look at the main benefits of effective invoicing, which emphasizes how it promotes transparency, powers up vendor and customer relationships, and minimizes administrative burdens.

Eliminate late payments

The most essential thing that is beneficial to your business in an invoicing tracking system is that through tracking, you can eliminate late payments from your clients.

Monitoring due dates and payment status will guarantee on-time payments without incurring expensive penalties. Well-tooled invoice tracking tools show reminders automatically with precise payment schedules, which means that your clients pay on time.

Centralize all information in one location

Using an invoice tracking tool will ensure that all your business invoices are centralized in one location, so you can easily find any record you need.

You can easily access and manage your clients’ details, payment status, and dates in one system. Centralized data management also ensures no rogue spending and invoice fraud, so financial integrity is kept. You will increase business, boost productivity, and receive the most effortless billing process.

In the end, you protect your company’s financial health by having all your invoice information in one place.

Enhance expense management

Tracking invoices effectively enhances expense management for your business.

By maintaining detailed records of all transactions, you gain clear insights into your spending patterns and financial commitments. This allows for more accurate budgeting and forecasting.

Advanced invoicing tools categorize expenses and generate reports, helping identify cost-saving opportunities and areas of overspending.

Ensure regulatory compliance and audit readiness

Effective invoice tracking ensures your business is always prepared for regulatory audits and compliance checks. By keeping detailed and organized records, you can respond effortlessly to any regulatory enquiries, reducing the risk of penalties and legal complications.

Automated invoice tracking tools also offer real-time visibility into financial transactions, ensuring all data is transparent and easily accessible.

This proactive approach enhances your audit readiness and also fosters trust with stakeholders and regulatory bodies, ultimately safeguarding your business’s reputation and financial health.

Improve overall business efficiency

Efficient invoice tracking elevates overall business efficiency by automating financial processes and reducing manual errors.

By streamlining the administrative side of your business, you and your team can quickly and accurately create invoices, track dates, and match invoice and purchase numbers through a centralized, standardized system.

Real-time insights into outstanding invoices and financial trends empower better decision-making and strategic planning.

Best Practices for Effective Invoice Tracking

To master how to keep track of invoices, it’s essential to implement best practices tailored to your business needs. We will explore key strategies and actionable tips to help your business streamline its invoicing system, facilitate timely payments, and improve overall financial management.

Optimizing Accounts Payable Processes

Automate Invoice Payments

Automating invoice payments is a game-changer for optimizing accounts payable processes.

By utilizing accounts payable software, you can schedule and execute payments automatically, significantly reducing manual data entry and eliminating human errors. This accelerates the payment cycle, and also ensures timely payments, enhancing vendor relationships and potentially securing early payment discounts.

The software can pull essential data from incoming invoices and initiate the approval process swiftly. Users receive real-time updates and enjoy end-to-end visibility of their financial activities, maintaining total control over cash flow.

Delegate Responsibilities Effectively

Business owners often find themselves too busy to manage their accounting processes. Effectively delegate responsibilities by outsourcing invoice tracking to a dedicated employee.

Using invoice tracking software can facilitate this delegation, as it allows you to supervise accounts payable processes remotely. In this way, you can stay on top of financial activities without being caught up in day-to-day tasks.

By freeing up your time for strategic decision-making while your team member handles the routine work, you streamline operations and boost overall business productivity and financial accuracy.

Generate Accounts Payable Aging Reports

Generating accounts payable aging reports is an essential practice for optimizing your accounts payable processes.

These reports provide a summary of outstanding bills and invoices, categorized by their due dates. This organized view allows you to easily see which payments are coming due and which are overdue, helping you prioritize actions accordingly.

By focusing on invoices that are nearing their due dates and addressing late payments promptly, you can maintain better control over your cash flow. Aging reports ensure you stay on top of your financial obligations, avoid late fees, and foster strong relationships with vendors.

Prioritize Vendor Payments Strategically

Categorize vendors based on payment terms, discounts for early payment, and their importance to your operations.

To maintain a steady cash flow, stagger your vendor payments instead of settling all bills at the end of the month. This strategy ensures you have sufficient funds for daily operations and new opportunities.

Additionally, timely payments to critical vendors help avoid supply chain disruptions. By managing payments strategically, you enhance financial planning, maintain strong vendor relationships, and improve overall operational efficiency.

THE REST AFTER THIS AD

Enhancing Accounts Receivable Management

Automate the Billing Process

Advanced billing software can automatically generate and send invoices, reducing manual efforts and minimizing errors.

This ensures timely issuance of invoices, leading to quicker payments and improved cash flow. Automatic reminders and follow-ups help maintain communication with clients, decreasing the likelihood of late payments.

Create Accounts Receivable Aging Reports

These reports categorize outstanding invoices based on their payment due dates, providing a clear snapshot of overdue accounts.

By regularly generating aging reports, you can identify late-paying customers, prioritize collection efforts, and address potential cash flow issues proactively. This structured approach helps maintain healthy cash flow, reduce bad debts, and improve financial planning.

With detailed aging reports, your business can take timely actions to recover overdue payments, ultimately enhancing overall financial stability and operational efficiency.

Integrate Billing with Accounting Systems

Integrating billing with accounting systems ensures seamless data flow between invoicing and financial records, reducing manual entry errors and saving time. It provides real-time updates on payment statuses.

It also facilitates better cash flow management by offering a holistic view of outstanding receivables and financial health.

Moreover, an integrated system can automate routine tasks such as generating statements and follow-up reminders, further streamlining operations.

Regularly Review Receivables Data

Regular reviews help you track overdue invoices, prioritize collection efforts, and adjust billing practices as needed. This proactive approach minimizes the risk of unpaid invoices and enhances financial stability.

Additionally, frequent reviews enable you to forecast future cash flows more accurately, aiding better financial planning.

Ultimately, staying on top of invoice tracking data ensures your business maintains a healthy cash flow and robust financial health.

Tracking Invoices with HubSpot

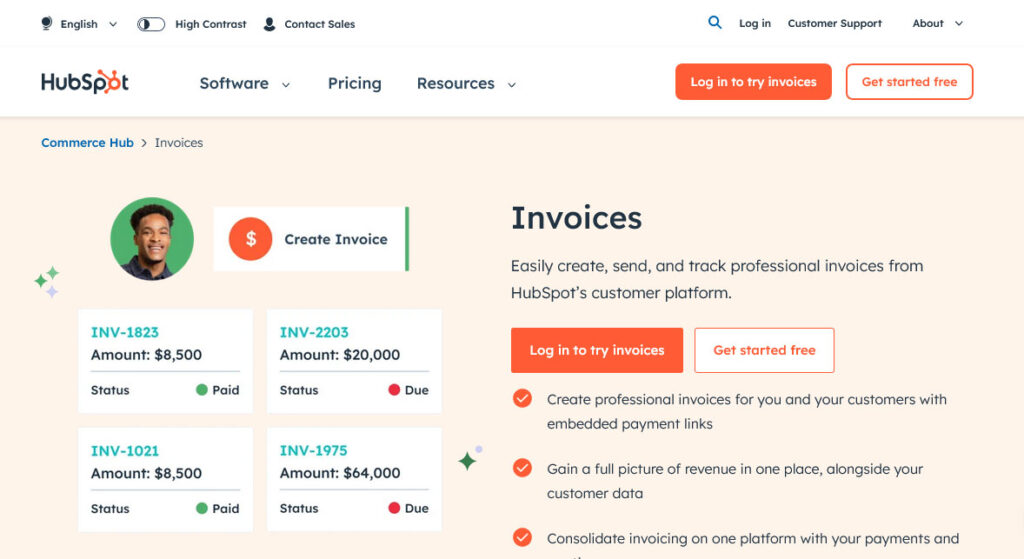

HubSpot invoicing tool provides a comprehensive solution for creating and managing invoices directly within the HubSpot environment. This feature is available with all HubSpot plans, including the free version, making it accessible to a wide range of businesses.

Key Features of HubSpot Invoices:

- Creation and Management: Generate invoices from the HubSpot invoice page, convert quotes to invoices, or sync with popular accounting software like QuickBooks and Stripe.

- Automated Messaging: Set up automated messages to notify overdue clients, improving your cash flow management.

- Embedded Payment Links: Include secure payment links in your invoices, allowing customers to pay directly via HubSpot Payments.

- Recurring Subscriptions & Lifetime Value Tracking: Monitor recurring payments and calculate customer lifetime value, providing valuable insights for your sales and marketing strategies.

Creating Invoices in HubSpot:

- Direct Invoice Creation: Directly generate invoices from the HubSpot invoice page, allowing for quick and efficient billing.

- Quote to Invoice Conversion: Seamlessly convert quotes into invoices within HubSpot, ensuring consistency and reducing manual data entry.

- Sync with Accounting Software: HubSpot integrates with accounting platforms like QuickBooks and Stripe, syncing invoices for a harmonious financial overview.

Value Addition through HubSpot Invoicing:

- Track Recurring Subscriptions & Calculate Lifetime Value: Monitor customer payments to gain insights into their lifetime value, coupled with website analytics and attribution data.

- Payment Status Monitoring: Easily track which customers have paid and which haven’t, enhancing your customer relationship management.

- Automated Invoice Creation: Utilize HubSpot’s workflow capabilities to automate invoice generation, saving time and reducing errors.

- Workflow Integrations: Create workflows to follow up on outstanding invoices, trigger reminder or nurture emails, and segment contacts based on their spending, significantly improving cash flow management.

- E-commerce Integration: Seamlessly connect with e-commerce platforms like Shopify or WooCommerce to streamline invoicing and order management.

Cost of HubSpot Invoices:

HubSpot Invoices solution is free for all HubSpot plans and products. However, some key features require additional costs. While creating and managing invoices is included at no extra charge, leveraging advanced functionalities might involve integrating with paid software like QuickBooks or HubSpot Payments, the latter of which is available only with a paid HubSpot subscription.

Conclusion

Effective invoice tracking is essential to maintaining a healthy cash flow and ensuring the operational success of your business. By using automation, generating detailed aging reports, and maintaining accurate financial records, you can efficiently manage accounts receivable and payable.

Tools like HubSpot offer comprehensive solutions that enhance invoice management, from creation to payment tracking, ultimately improving efficiency and client relationships.

Centralizing invoice data boosts transparency, and also facilitates tax preparation and audit readiness. Implementing these strategies will improve overall business efficiency, enhance vendor and customer relationships, and secure your company’s financial future.