Table of Content

Inefficient invoice management is a common challenge that leads to financial strain and operational disruptions for many businesses.

Addressing this issue is crucial for maintaining a healthy cash flow and ensuring smooth operations. This comprehensive guide will provide businesses with effective strategies and tools to streamline their invoicing process.

From selecting the right invoicing software to mastering follow-up techniques, this guide covers everything business owners need to manage their invoices efficiently and set their business on a path to sustained success.

What is Invoice Management?

Invoice management refers to the systematic approach companies use to track, process, and pay supplier invoices. This essential business function ensures timely payments and verifies the authenticity of each invoice, preventing errors and fraud.

The process begins when a company receives an invoice from a supplier. Each invoice is meticulously reviewed to confirm that the details align with the goods or services provided. This involves checking for accuracy and completeness, such as ensuring the quantities, prices, and other terms are correct. Once validated, the invoice moves through the approval process, where it is authorized for payment.

Upon approval, the company processes the payment, ensuring it is made promptly to maintain good relationships with suppliers and avoid late fees.

Additionally, all invoice details and transaction records are systematically stored in a database. This organized record-keeping facilitates easy access for future reference and audits.

THE REST AFTER THIS AD

The Different Types of Invoices

There are various types of invoices, and understanding them is crucial for efficient financial management. Each type serves a specific purpose, ensuring accurate billing and payment processes. Let’s explore the different types of invoices and their unique roles in business transactions.

- Standard Invoice: It is issued by a seller to a buyer that details the products or services provided, their quantities, agreed prices, and the total amount due. It serves as a formal request for payment and typically includes payment terms, seller and buyer information, and an invoice number for reference.

- Pro Forma Invoice: It is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It outlines the estimated costs of goods or services, including detailed descriptions, quantities, and prices, but it is not a demand for payment. Instead, it provides an overview of the expected charges and terms.

- Recurring Invoice: It is regularly sent to customers for ongoing or subscription-based services and products. It automatically generates and dispatches at predefined intervals, such as weekly, monthly, or annually. This invoice typically includes details of the recurring charges, due dates, payment terms, and any other relevant information to ensure consistent and timely payments.

- Credit Memo: It is issued by a seller to a buyer, indicating a reduction in the amount owed by the buyer. This can occur due to a variety of reasons, such as returned goods, overpayments, or billing errors. The credit memo specifies the amount credited, along with details of the original transaction it relates to, thereby adjusting the buyer’s account balance and effectively serving as a refund or a partial value adjustment.

- Debit Memo: It indicates an increase in the amount the buyer owes. This can happen due to reasons such as additional services provided, correction of billing errors, or undercharging in the original invoice. The debit memo specifies the additional amount owed and provides details of the original transaction it relates to, effectively adjusting the buyer’s account balance upwards.

- Commercial Invoice: It is typically used in international trade. It outlines the goods being shipped, including descriptions, quantities, and prices, as well as important information such as the buyer and seller details, shipping terms, and the total value of the transaction. This invoice is crucial for customs clearance and helps determine duties and taxes that need to be paid.

- Time-based Invoice: It is a billing used to charge clients for services rendered based on the amount of time spent. This type of invoice typically includes a detailed breakdown of the hours or units of time worked, the rate per hour or unit, a description of the tasks performed, and the total amount due. It is commonly used by professionals and service providers such as consultants, freelancers, lawyers, and contractors to ensure accurate and transparent billing for their time and efforts.

How to Manage Invoices Effectively?

Whether you are a small business owner or part of a large corporation, understanding the intricacies of manual and automated invoice processes is essential. Let’s delve into the specifics of each method, comparing their benefits and drawbacks, and ultimately helping you decide which approach aligns best with your business strategy.

Manual Invoice Management process

Manual invoice management leverages human expertise to process invoices, following a series of meticulous steps.

The process begins with receiving the invoice, followed by extracting and verifying the data against the physical document. Invoices are then internally assigned for processing, entered into accounting software or spreadsheets, verified, approved, and finally paid.

Despite its reliance on physical bills and receipts, this approach is fraught with challenges.

Human errors can contaminate data, cause payment delays, and disrupt cash flow, potentially damaging the company’s reputation and vendor relationships.

Physical record-keeping also makes data vulnerable to loss, corruption, or breaches and hampers search functionality, thereby increasing processing time. Delayed payments can result in significant fines, leading to substantial financial losses.

Thus, while manual invoice management provides control and relies on human judgment, it is often inefficient and risky compared to automated solutions.

Automated Invoice Management process

Automated invoice management leverages software to efficiently extract, process, store, and manage invoice data. It streamlines and automates the time-consuming and repetitive steps found in manual invoice management.

The automated process includes:

- Automatic extraction of data in digital format.

- Routing invoices for approval with notifications to the relevant approvers.

- Verifying and approving (or rejecting) invoices.

- Processing payments seamlessly.

- Storing invoices and payment details in the accounting system.

This end-to-end automated approach ensures a smooth workflow, from data entry to digital archiving. This system reduces errors, speeds up processing times, and improves overall efficiency by eliminating manual intervention. However, it does require integration with accounting software, which may take time to set up.

Manual vs. Automated Invoice Management: Which is Best?

Choosing between manual and automated invoice management systems depends on the specific needs and goals of your business.

Manual invoice management involves painstaking data extraction from paper invoices, which can be time-consuming and prone to errors. This traditional method lacks a digital database, making records vulnerable to loss and difficult to track.

Additionally, the approval process is often slow, and making payments manually can be inefficient. Overall, manual systems struggle with real-time invoice tracking and lack opportunities for rewards or early payment discounts from vendors.

In contrast, automated invoice management offers numerous advantages. E-invoicing simplifies data capture, ensuring accuracy and significantly reducing the likelihood of errors.

All data is securely stored on cloud-ready architecture, safeguarding against loss and facilitating easy access. The approval process is streamlined and swift, enabling faster decision-making. Automated systems also allow for seamless payment processing, with the potential for automatic fund transfers.

Moreover, businesses can easily track invoices in real time and benefit from possible rewards and discounts for early payments.

Automated Invoice management offers benefits such as on-time payments, improved vendor relationships, increased credibility, and significant cost savings.

Enhanced compliance and the considerable time saved on manual processing further justify the investment in accounts payable automation. For businesses aiming to optimize their financial operations, automated invoice management is the superior choice.

Top Automated Invoice Management Platforms for Businesses

THE REST AFTER THIS AD

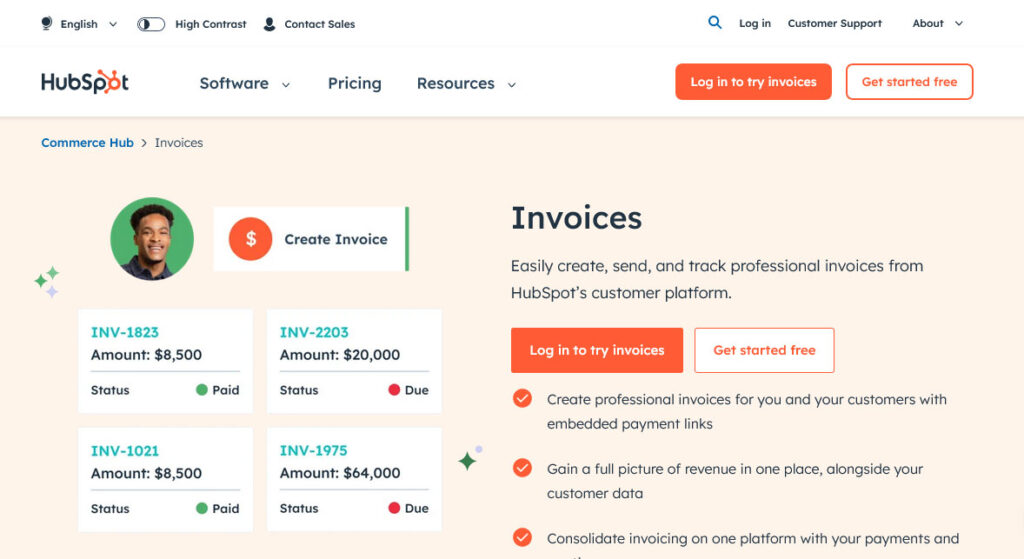

HubSpot

HubSpot, renowned for its CRM, marketing, sales, and customer service software, has recently expanded its offerings to include robust invoicing tool.

With the introduction of the HubSpot Payments feature, users can now create and manage invoices directly within the platform, streamlining their financial operations.

This native invoicing feature marks a significant shift for businesses that previously relied on external solutions or manual tracking for their invoicing needs. It allows users to generate and send invoices to customers, track payment statuses, and automate follow-up reminders for unpaid invoices.

Additionally, this feature integrates seamlessly with HubSpot’s existing CRM data, ensuring a cohesive and efficient workflow.

Invoicing within HubSpot is free and easy to activate, providing businesses with a cost-effective solution for managing their invoices. The combination of invoice management and payment processing in one platform makes HubSpot a comprehensive tool for businesses looking to optimize their financial processes.

LEARN MORE ON HUBSOPT INVOICE TOOL

Bill.com

Bill.com is a cloud-based software platform designed to streamline financial workflows for small and medium-sized businesses, accounting firms, and financial institutions.

With this platform, you can eliminate the need to handle paper documents, filing, and data entry. It allows you to capture invoices, approve payments, and manage reconciliations entirely online. This increases work efficiency and also contributes to a more sustainable environment by minimizing paper waste.

Bill.com also ensures that you maintain full control over your financial operations. You can set up custom approval workflows, assign role-based access, and even automate recurring payments. The powerful automation capabilities are guided by the rules you specify, ensuring you spend less time on administrative tasks and more on growing your business.

Security is another strong suit of this automated invoice management platform. The platform leverages artificial intelligence to conduct risk assessments, reducing the likelihood of fraud. Additionally, the automated Positive Pay service offers protection against check fraud, allowing you to manage your finances with peace of mind.

Freshbooks

FreshBooks serves as a comprehensive invoice management software tailored to meet the needs of businesses seeking streamlined financial operations. Offering robust templates and easy payment solutions, this platform facilitates an intuitive invoicing experience.

It supports credit card payments and ACH, with automated reminders and notifications to ensure timely settlements. For businesses managing a large client base, FreshBooks offers unlimited invoicing capabilities, dependent on the plan selected.

Clients can enjoy a self-service portal, making it simple to track their invoices and report sales tax. Plans that include payment via checkout links offer enhanced flexibility, while features like auto-reconciliation of invoices streamline financial tasks.

Users can access FreshBooks via iOS and Android mobile apps, providing easy accessibility at any time. Invoice data can be imported and exported seamlessly, with OCR technology enabling efficient data extraction. Real-time tracking of invoices ensures businesses stay updated on their financial status.

However, this automated invoice management software has some limitations. It lacks real time invoice reports and does not support three-way matching, which could be a drawback for businesses needing these advanced features.

LEARN MORE ON FRESHBOOKS PLATFORM

Spendesk

Spendesk is a comprehensive invoicing app designed to monitor and streamline the entire invoice management process, from procurement to payment. The platform enhances efficiency by simplifying approval workflows and managing budgets effectively, thereby minimizing invoicing errors and inconsistencies.

Leveraging OCR technology, this invoice management system extracts data effortlessly, reducing manual input and errors. The software integrates with various accounting systems, ensuring smooth financial operations and auto-reconciliation of invoices.

It provides complete visibility for project management, enabling businesses to track expenses and invoices in real-time. The platform supports bulk invoicing and updates budgets as transactions occur, offering real-time financial insights. Smart card payments and real-time invoice reports further enhance the financial control offered by Spendesk.

Despite its many advantages, it does have some limitations. It lacks an invoice discounting option and does not offer a one-day invoice turnaround time, which might be a consideration for some businesses. However, its deduplication algorithm ensures that duplicate invoices are never an issue.

LEARN MORE ON SPENDESK PLATFORM

Zoho Invoice

Zoho Invoice is a cloud-based solution designed to automate the entire invoicing process for businesses. From creating invoices to tracking time, collecting payments, and generating detailed invoice reports, the platform simplifies complex tasks with its intuitive interface.

It streamlines the creation and sending of invoices, credit notes, and retainers, and supports automated payment reminders to ensure timely collections. The platform includes a customer self-service portal, enabling clients to view and manage their invoices easily.

With real-time invoice tracking and project management features, businesses can stay on top of their financial activities and billable hours.

Integrations with various accounting and payment software further enhance its utility, allowing seamless financial operations. Digital and recurring billing options are available to meet the diverse needs of different businesses.

With over 30 built-in invoice reports and features like batch invoicing and auto-reconciliation, Zoho Invoice offers extensive reporting and efficiency. Although it provides a 14-day free trial, it lacks a one-day invoice turnaround time and is not tailored for large enterprises, which could be potential drawbacks for some users.

However, small to medium-sized businesses will find Zoho Invoice’s range of features highly beneficial. The platform’s ability to integrate with multiple payment gateways ensures smooth transactions, while its mobile accessibility supports flexibility for business operations anywhere, anytime.

LEARN MORE ON ZOHO INVOICE PLATFORM

Conclusion

Mastering invoice management is essential for any business seeking to optimize its financial processes and sustain growth.

This blog post has explored the challenges and solutions, from manual to automated systems, and highlighted top platforms. Each offers distinct advantages tailored to various business needs, including automation, seamless integrations, and real-time tracking.

Business owners should invest in effective invoice management tools to take a strategic step towards improved operational efficiency and long-term success.